August 01, 2024

Flybridge's Partnership with Metal

Taylor Lowe

For more than twenty years, Flybridge Capital Partners has been a leader in the startup and venture capital community, transforming early stage startups into market leaders and household names. Their track record is seriously impressive, partnering with transformational companies across various industries, including MongoDB, Nasuni, and Chief, to name a few.

With over $1 billion in total assets and counting, Flybridge prides themselves on being early adopters of transformative technologies. While the current explosion of AI tools is new to many, Flybridge has been investing in the space since 2010. So when generative AI took off in early 2023, they knew that most sectors would be disrupted – including their own. They began to explore how the technology could be leveraged internally to create advantages and dramatically improve their investment process.

After experimenting with both in-house systems and off-the-shelf tools, Flybridge quickly realized the complexity of implementing a high-quality, scalable AI solution for their investment staff (if you’re curious, they wrote a fantastic write up on some of their learnings here). While foundational models like ChatGPT helped show AI’s potential, there were noticeable gaps in processing the multi-faceted data that Flybridge works with every day. This limited Flybridge’s ability to truly leverage the capabilities of AI across their portfolio.

It was at this point that Flybridge connected with our team at Metal, initiating a partnership that pushed our product forward and unlocked unprecedented capabilities for the venture capital community.

The Challenge

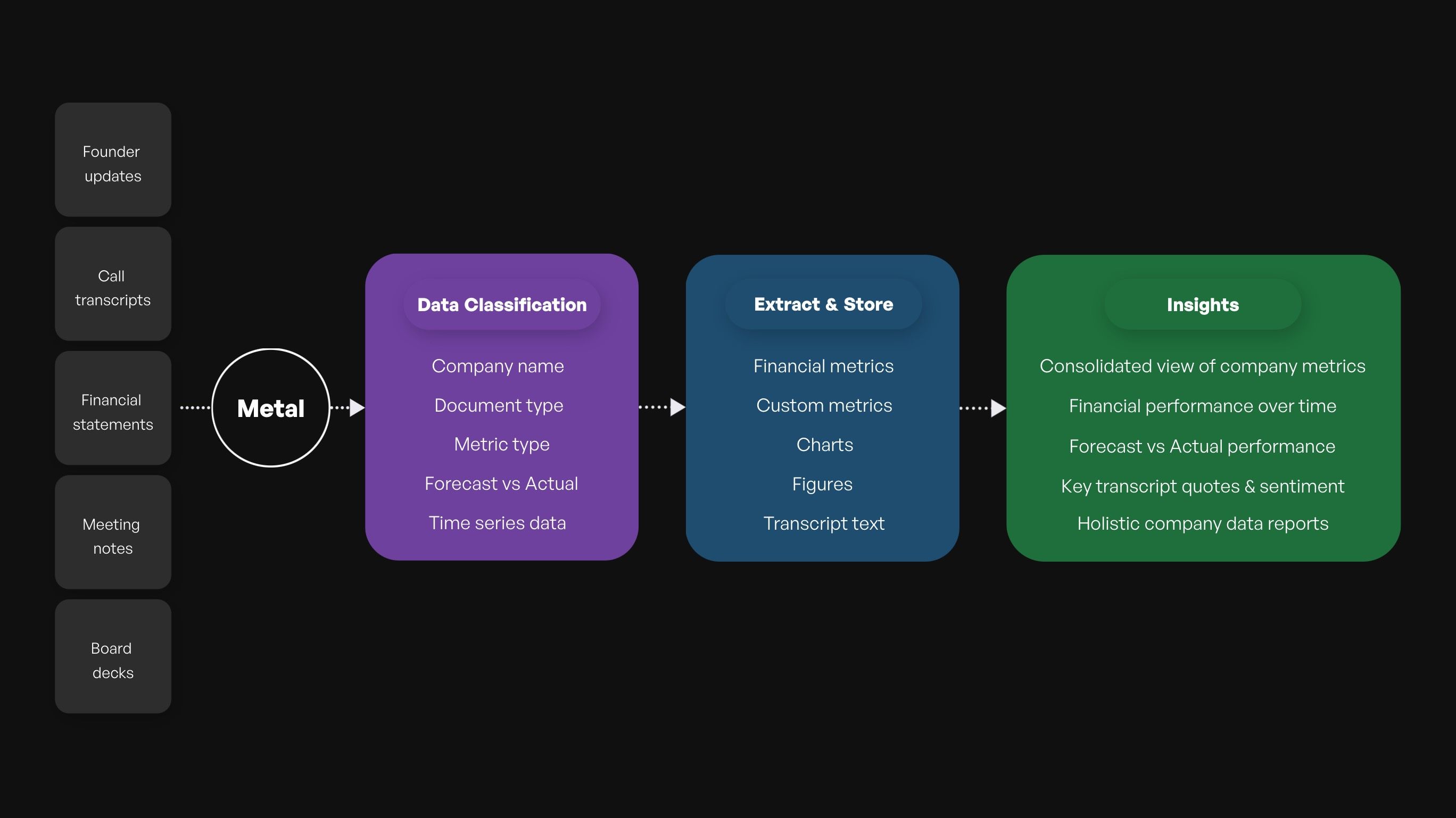

Flybridge is sitting on decades of data from their portfolio companies, with new information flowing in daily. From early-stage pitch decks to years of company financials, their team knew there were years of insights sitting in storage. This has been a big focus of our partnership, with a goal of empowering Flybridge with greatly improved visibility into hundreds of companies and sectors. Their challenges were twofold:

1. Streamlining the portfolio company update process. Every month, their team manually processes hundreds of company updates from founders. These updates contain critical information about each company's performance. How could they extract all of this data and store it in one place?

2. Automating company insights. Given their extensive portfolio, Flybridge needs to understand key insights from each founder's update. How can they quickly pinpoint crucial information and identify areas where their team can add value?

This is highly complex from a data processing perspective, as each company update includes multimodal data like board decks, financials. emails, call transcripts, and more. Flybridge’s needs were more advanced than what any AI solution was capable of.

Excited by this challenge, our team quickly got to work!

Evolving Metal to Meet Flybridge’s Needs

Our first run of data processing revealed some obvious areas of improvement.

Charts & Figures

For one, files like board decks and presentations contain plenty of charts and figures. These visual elements are particularly challenging due to the wide variety of formats, including bar charts, line graphs, and pie charts, among others. What’s more, the out-of-the-box language models Flybridge tested consistently struggled processing these data types.

So our team focused on this first, augmenting Metal’s processing capabilities to work with visual data.

Example of charts and figures in Metal:

Charts & figures

Now, Metal can process charts and figures contained in source documents. This data is easily accessible throughout the application, and is stored as collective knowledge for the Flybridge team to access.

Time Series Data & Forecasts

This development revealed another key need: time series data. While Metal was extracting metrics from each update, they weren’t anchored to specific points in time. In addition, every company update included both forecasted figures and actual results for each metric— an essential distinction for assessing performance trends.

To address this, our team refined Metal's extraction capabilities to incorporate time values and distinguish between forecasted and actual figures. With these enriched metrics stored in Metal, we could then implement automated comparisons of expected versus actual performance.

Example of forecast vs actual metrics:

Forecast vs actual

Connecting to Metals API

With our enhanced data and metric processing capabilities in place, we then focused on streamlining the founder update workflow itself. The primary challenge was scalability, as manually uploading each update into Metal was not practical.

Since these updates arrive via email, and often include attachments like financial statements or decks, we leveraged Metal's API to integrate with Flybridge's inbox. This connection enables automatic processing of every founder email and attachment, without any changes required to Flybridge’s workflow.

Further, all data we process in Metal uses private APIs, ensuring that no information is passed back to model providers or is used for training purposes. This approach safeguards the confidentiality of all founder updates, as well as any data in our system.

Custom Metrics

Lastly, extracting custom metrics for each company was crucial. Given Flybridge’s diverse portfolio, they needed to accommodate varying data points across different business models and industries.

To support this, we enabled customizable metric extraction on a per-company basis.

Example of custom metrics:

Custom metrics

This allowed Flybridge's team to define the most relevant metrics for each business in their portfolio, customizing what is extracted from every file in relation to individual companies.

Custom metrics are not just limited to financial numbers either, as you can define values like customer count, NPS, or retention rates.

Supercharging the Process

Before Metal, Flybridge managed their portfolio updates through a complex, multi-step process spanning several systems. This approach demanded significant manual effort, with each new portfolio addition further increasing the workload.

Now able to capture company updates with ease, the Flybridge team is positioned to explore their portfolio through Metal’s analysis capabilities. Their team has a live view of how their portfolio is performing over time, and can extract insights from every document shared by their companies.

Flybridge workflow

For example, Flybridge can use Metal’s reports to generate qualitative write ups across all of the portfolio data that’s indexed in Metal, providing a detailed overview of the most important events in a company’s history. Or they can drill down, using Metal's search or chat capabilities to zero in on specific details of board decks or direct quotes in transcripts.

This frees up time from operational tasks, streamlines their reporting process, and enables them to focus on higher value work to support their portfolio companies.

Partnership Driven Development

We’re still in the early stages of the AI platform shift, but we’re incredibly bullish on customer partnerships being the key driver to building winning products. This is especially true for a specialized industry like venture capital. We’re so grateful to partner with leading funds like Flybridge, who’s forward thinking helps explain their twenty plus years of success – and why we're excited for what we’ll build next!

And while our customers realize huge efficiency gains with Metal today, our long term goal is to help surface novel insights across company data that even the best teams might otherwise overlook.

If your fund is interested in working with our us, we’d love to hear from you. Every month we partner with more funds to help augment their investment process, increasing efficiency, and uncovering insights.